A few charts for those who follow this blog regularly:

Firstly, the U.S. dollar:

The U.S. dollar is butting-up against resistance on the monthly chart. This is obviously a big level and would dictate moves in other markets, depending on the outcome. Breaking through here could lead to further dollar gains.

If we pull-back, I would expect another test towards this level.

Gold:

A rally occurred recently in gold, but seems to have died out (FED/Stocks) a little. $1250 is initial resistance to see if we can continue to $1400. Failure to get above here could see the next leg down for a low.

Oil:

Oil is still weak. A weekly close under $50 and we may see lower 40s soon. A counter-trend rally should come soon in oil, which get all talking about a bottom. $35/40 is a good place for a bottom but we might not see significant oil gains again until 2016, or beyond...

Showing posts with label Gold. Show all posts

Showing posts with label Gold. Show all posts

Thursday, 8 January 2015

Saturday, 27 December 2014

The smart investor's guide to gold

I have just finished writing a new ebook: "The Smart Investor's Guide To Gold".

The book is available in the Amazon Kindle store here: http://www.amazon.com/Smart-Investors-Guide-Gold-ebook/dp/B00RHULU00/ref=sr_1_1?ie=UTF8&qid=1419716433&sr=8-1&keywords=smart+investors+gold

"The Smart Investor's Guide to Gold" is a professional and unbiased look at the investment considerations of gold as an asset, alongside an analysis of the current monetary and financial regime to provide a smart investment strategy for gold.

The book is based on the the same research and analysis that I use throughout the blog. In my opinion, too many writings on gold are based on scare stories and get-rich-quick schemes, which has cost investors a lot of money over recent years. I fully support the use of gold in portfolios, and believe we are nearing a bottom in gold prices, yet we must still observe the cycles and trends in order to invest wisely.

The book is available in the Amazon Kindle store here: http://www.amazon.com/Smart-Investors-Guide-Gold-ebook/dp/B00RHULU00/ref=sr_1_1?ie=UTF8&qid=1419716433&sr=8-1&keywords=smart+investors+gold

"The Smart Investor's Guide to Gold" is a professional and unbiased look at the investment considerations of gold as an asset, alongside an analysis of the current monetary and financial regime to provide a smart investment strategy for gold.

The book is based on the the same research and analysis that I use throughout the blog. In my opinion, too many writings on gold are based on scare stories and get-rich-quick schemes, which has cost investors a lot of money over recent years. I fully support the use of gold in portfolios, and believe we are nearing a bottom in gold prices, yet we must still observe the cycles and trends in order to invest wisely.

Friday, 19 December 2014

Weekly closings - Stocks, Oil, Gold

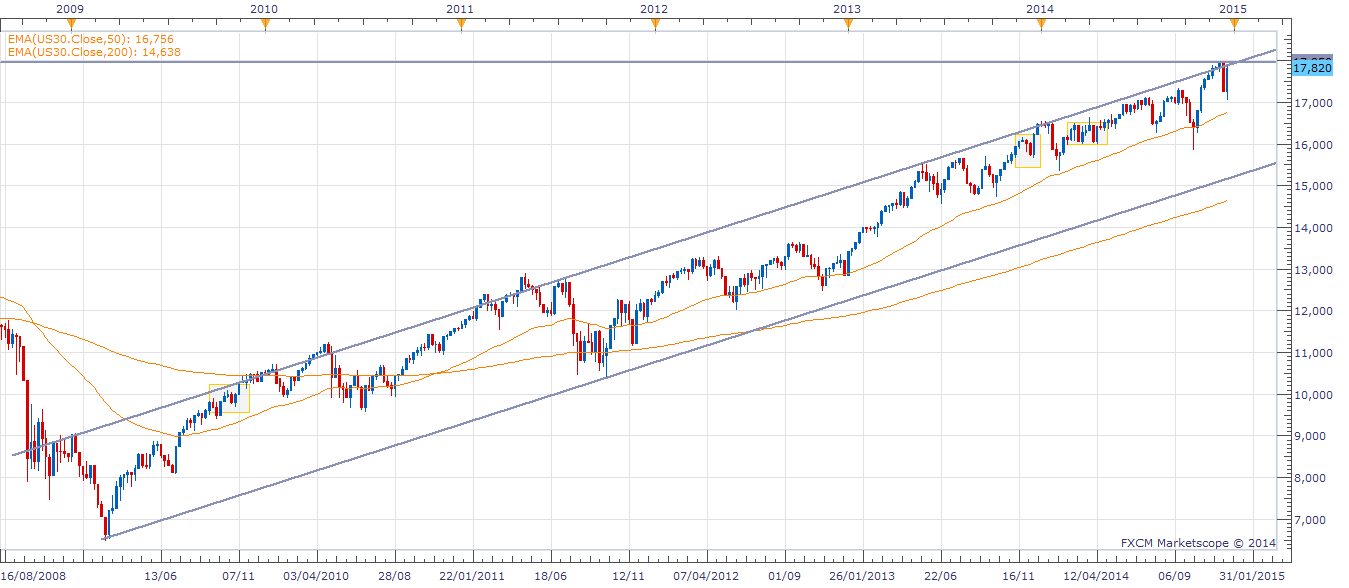

Stocks

Another strong weekly close has been elected by the Dow bulls and we have approached some key overhead resistance.

The market has closed strongly through 17,800 and now eyes 18,000. Support above 18,000 and we would likely see clear-blue-skies for the equity markets again.

Love it, or hate it, I have written on the subject recently to give some ideas: http://seekingalpha.com/article/2634995-equity-bears-still-dont-get-it

I still don't think we have seen the 'blow-off' style top that accompanies bull markets like this, although, as the NASDAQ approaches it's all-time high I may be proved wrong. There is still the option that if sovereign debt contagion was to happen through Russia, Venezuela, emerging markets, Japan, Europe (large list) then tech may be shunned for 'bellweather' industrial stocks. We watch and wait.

If you think this action is crazy on stocks, understand that markets have exhibited the same types of insanity for over a hundred years or more. Psychology takes over from fundamentals until the top. We will however look back one day and see where the inflection points were. Until then, you have to stay with the trend.

'Don't fight the Fed' but protect the downside on longs.

Oil

Crude Oil has put in a promising bullish close this week and may stabilize/rally from here. Obvious target is to clear $60 and test $70.

I'm still wary of the $40 level but in my previous posts you'll see I talk about price action. Rallies happen in the middle of a basing setup. Market feeling for its lows.

Gold

A disappointing close for gold, with a bearish candle on the week and failure at $1200. This can all change rapidly in such a risky global economy and as the Dow reaches strong overhead resistance, it wouldn't be a surprise to see a top in stocks, rally in gold and oil.

On a portfolio basis, I am looking at oil ETFs and strong balance sheet oil/energy plays that have been unfairly dragged down.

Exxon for example, can be bought around 11-times earnings against Facebook's 70-times. No contest.

I will continue to look for a bottom in gold to test the highs but may come mid-2015.

If I see support on S&P or Dow then I might play ETFs with futures exposure incase of blow-off top mentioned above.

Good luck trading and please buy my book, advertised on the left to build the investment skills that I try to share here.

Another strong weekly close has been elected by the Dow bulls and we have approached some key overhead resistance.

The market has closed strongly through 17,800 and now eyes 18,000. Support above 18,000 and we would likely see clear-blue-skies for the equity markets again.

Love it, or hate it, I have written on the subject recently to give some ideas: http://seekingalpha.com/article/2634995-equity-bears-still-dont-get-it

I still don't think we have seen the 'blow-off' style top that accompanies bull markets like this, although, as the NASDAQ approaches it's all-time high I may be proved wrong. There is still the option that if sovereign debt contagion was to happen through Russia, Venezuela, emerging markets, Japan, Europe (large list) then tech may be shunned for 'bellweather' industrial stocks. We watch and wait.

If you think this action is crazy on stocks, understand that markets have exhibited the same types of insanity for over a hundred years or more. Psychology takes over from fundamentals until the top. We will however look back one day and see where the inflection points were. Until then, you have to stay with the trend.

'Don't fight the Fed' but protect the downside on longs.

Oil

Crude Oil has put in a promising bullish close this week and may stabilize/rally from here. Obvious target is to clear $60 and test $70.

I'm still wary of the $40 level but in my previous posts you'll see I talk about price action. Rallies happen in the middle of a basing setup. Market feeling for its lows.

Gold

A disappointing close for gold, with a bearish candle on the week and failure at $1200. This can all change rapidly in such a risky global economy and as the Dow reaches strong overhead resistance, it wouldn't be a surprise to see a top in stocks, rally in gold and oil.

On a portfolio basis, I am looking at oil ETFs and strong balance sheet oil/energy plays that have been unfairly dragged down.

Exxon for example, can be bought around 11-times earnings against Facebook's 70-times. No contest.

I will continue to look for a bottom in gold to test the highs but may come mid-2015.

If I see support on S&P or Dow then I might play ETFs with futures exposure incase of blow-off top mentioned above.

Good luck trading and please buy my book, advertised on the left to build the investment skills that I try to share here.

Labels:

Bulls,

crude oil,

Dow Jones,

FED,

Gold,

Investor psychology,

NASDAQ,

Oil,

Sovereign Debt,

Stocks

Thursday, 18 December 2014

Oil charts look ominous

Despite a bounce on OPEC's statement that low oil was "temporary", the chart has fallen back to give a bearish signal. With the stock market rising strongly off the FED announcement and gold looking a little weak also, it's possible we will get another leg up in risk, with a leg down in commodities.

The weekly chart doesn't look any better on crude oil and the levels at $50, and more so $40, look like a potential magnet zone for crude. I wouldn't be surprised to see these levels targeted in the "risk off" move that I mentioned.

***I went long oil at $60, with an extra position at 55, which allowed me to take the second portion at $60.

I will hold off any other buying now but the lows at $40 would be a strong entry for me. Further lows will ensure that oil stays depressed into 2015 but there are always bounces to take advantage of.

Remember also, that OPEC cut production by 75% in the 1980s and couldn't halt price so awaiting their actions here is also futile. As yesterday and today's rally showed, OPEC created a small opportunity to cut loss or take a small profit,

The 1980s chart is shown below for reference:

If the oil price was to stay depressed through 2015 - 2017 it would do considerable damage to economies and corporations as it did in the 1980s.

Wednesday, 17 December 2014

Gold update for the week

Gold has stuttered around the $1200 level and has failed to see continuation into the preferred zone.

The Fed comments today gave a rally to stocks and could create a 'risk-off' situation into the weekend, following a turbulent week.

Continued weakness into the weekend could see another leg down towards $1000.

The Fed comments today gave a rally to stocks and could create a 'risk-off' situation into the weekend, following a turbulent week.

Continued weakness into the weekend could see another leg down towards $1000.

Subscribe to:

Posts (Atom)