The Swiss bank stated only last month that they would defend the 1.20 floor at all costs, implementing negative interest rates, in an attempt to deflect Russian capital flows, fleeing the turmoil in the Ruble. Since the bank's announcement however, the snap election scheduled in Greece for January 25th is sure to see anti-austerity party Syriza taking control, while the ECB edges closer to a QE program. Analysts have suggested there is only a 20% chance of a Greek exit from the Eurozone, according to Bloomberg, yet many of these so-called analysts are politically pressured to avoid rocking capital markets and the bond markets will decide the fate of Greece as they did during the last crisis.

With this in mind, we should look at current events as a prelude to another Eurozone crisis and we need to follow capital flows, in order to predict future market movements. In my post of year-end closings I concluded that the Euro would make a certain test of the 1.20 level. This has occurred and we have now crashed through it to 1.15. For those who weren't paying attention, we are now lower than the levels of the Eurozone crisis and the lowest levels in over 10 years.

The Euro is now on a date with parity.

Gold is now looking to test the long-term trend-line around $1300 and it's possible that some smart money has bought into gold. I would be wary of this level and would need to see more follow-through. We may see a further drop in gold - possibly on forced liquidations - before we get the final multi-year low.

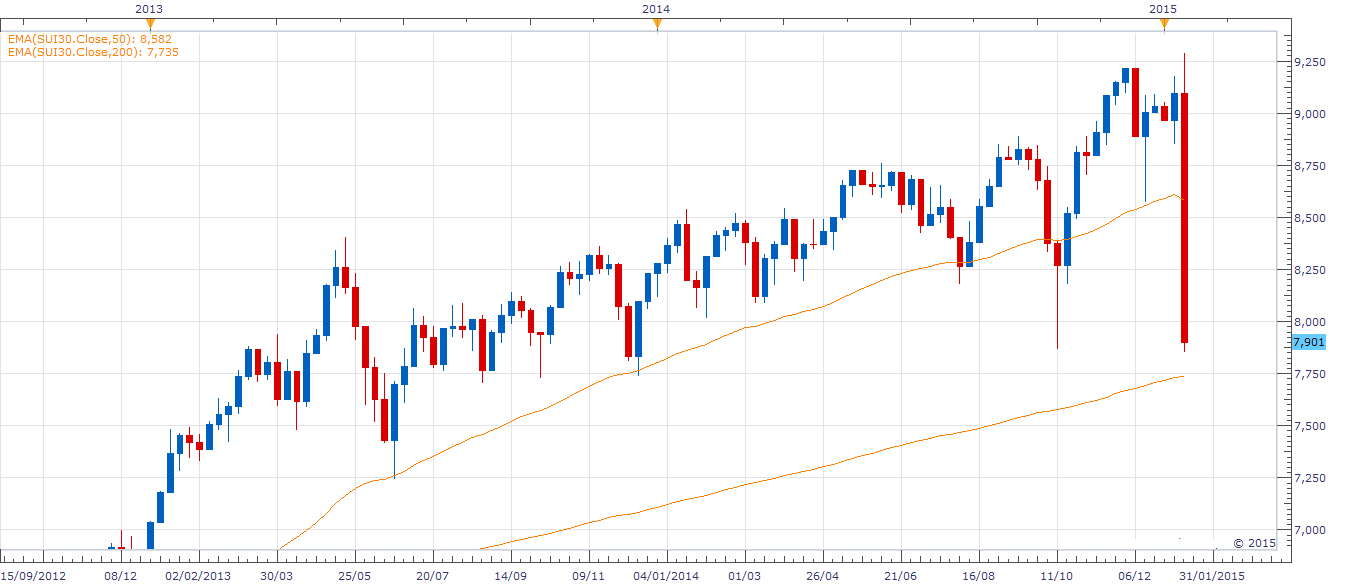

Stocks in the Swiss Market Index have been crushed since the news, with exporters being hard hit on the currency moves.

In contrast, the DAX is hitting record highs, while the Dow is falling from tough resistance.

So what's going on in the markets? Bonds in Greece and the Eurozone have fallen over the last month as the markets feared the consequences of a Syriza victory, but have bounced a little recently on hopes of a softened stance from Syriza. Following the SNB's move, the smart money has now exited the Swiss market due to currency valuations and investors are now seeking security in Swiss bonds, where the ten-year has gone negative, and in Germany, who have also seen yields falling. The advance in the Dax is showing that investors are also happy to take positions in the large-cap European stocks, rather than invest in peripheral bonds, with the safe havens now going negative. Despite comments within the EU that Greece would not create systemic problems, the markets still do not trust these views, while the SNB's U-turn only underlines the risks of trusting the power of policy-makers over markets.

These movements are important to understand if we are to see further turmoil in Europe after the Greek election. The Euro looks destined to hit parity against the dollar; gold will find a bottom soon (if it hasn't already); and bond investors will shun peripheral, risky bonds preferring to accept negative returns rather than take the risk of large bond losses or bank bail-ins like we saw in Cyprus. This is not a time to be taking positions in risky bonds, or in areas such as Greek shares. With the ECB looking to implement QE and the risk of contagion from Greece once again, this is a time to be cautious. The problems that we have seen in the currency brokers is another note of caution for investing in risky areas.

No comments:

Post a Comment