I have mentioned the key levels we need to watch on on gold. $1200 was the first resistance which would open up a run to the long-term trend-line and possibly $1400.

We are testing the trend-line on gold now and this is an area of caution for gold traders or investors. The rally in gold is due to the cracks reappearing in the Eurozone. The SNB removed their peg and telegraphed the rumoured QE program ahead of the meeting. Greece goes to the polls on Sunday and this QE program is simply a bailout for member states and the sovereign debt risks which a Greek exit would pose.

A further rally in the U.S. dollar could take us back down from this trend-line in gold. This would create an opportunity for the final lows in gold, which will occur before the U.S. economy turns down and gold can mount a serious run once again.

Investment FTS

Learn how to follow the smart money

Thursday, 22 January 2015

Wednesday, 21 January 2015

Calling the USD/CAD strength

In my last update, I advised that the USD/CAD was approaching strong resistance around 1.18. I also stated that strength beyond that level would see us make a move for the long-term highs at 1.30. See the article here: http://investfts.blogspot.co.uk/2014/12/usdcad-update.html

The Bank of Canada has since provided the catalyst for our move, announcing a shock interest rate cut of 0.25% The market will now make a move for 1.30 as previously suggested.

Follow the trends, position yourself accordingly, and then let the markets do your bidding. The majority of speculators will have been looking for a short on USD/CAD, but the majority don't win.

Short the weak; go long the strong!

The Bank of Canada has since provided the catalyst for our move, announcing a shock interest rate cut of 0.25% The market will now make a move for 1.30 as previously suggested.

Follow the trends, position yourself accordingly, and then let the markets do your bidding. The majority of speculators will have been looking for a short on USD/CAD, but the majority don't win.

Short the weak; go long the strong!

Monday, 19 January 2015

The CHF and investment success

The 30% move in the Swiss Franc is a prime example of how you can apply a contrarian attitude to the markets for investment success.

Let's underline the contrarian idea further: your success in investment will have a strong correlation to avoiding the herd mentality; the advice of non-experts; and an ability to control your emotions. The recent activity in the Swiss Franc is a clear example of this.

If you follow the mainstream media, you would have had the opinion that the SNB would be able to hold the 1.20 peg for as long as they desired. To find an edge and succeed in the investment game, you must be able to craft your own ideas. Any advice or hunch that you receive must be tested with your own techniques before getting involved.

Once again, we can look at the futures positioning and see the relationship between commercials and speculators.

Let's underline the contrarian idea further: your success in investment will have a strong correlation to avoiding the herd mentality; the advice of non-experts; and an ability to control your emotions. The recent activity in the Swiss Franc is a clear example of this.

If you follow the mainstream media, you would have had the opinion that the SNB would be able to hold the 1.20 peg for as long as they desired. To find an edge and succeed in the investment game, you must be able to craft your own ideas. Any advice or hunch that you receive must be tested with your own techniques before getting involved.

Once again, we can look at the futures positioning and see the relationship between commercials and speculators.

The chart is from USD/CHF but you can see clearly (highlighted in yellow) the activity of both groups. The commercial futures positions (blue line) were rising, signifying that they expected the CHF to gain in value. On the other hand, we have speculators (black line) reducing their exposure to longs on the CHF and going short.

The weekly chart on the EUR/CHF also shows a clear downtrend in the pair and a probe of the 1,20 level.

As price began to test the level, it was clear that there was no SNB buying to take the pair higher. At this stage we have speculators piling in expecting the central bank to make a move and give them a quick profit on their longs. Unfortunately for them, the SNB never appeared.

The Swiss Franc episode must be used as an example of trying to get an easy profit in the markets. The downside of playing with the peg is too risky to get involved - from both sides - so it is important to step aside, or at least find your analysis to gauge the risks.

Had you followed the media and made your decision on the non-experts in the financial media and their religious view of central banks, you would've been blown out. Now that the CHF has plunged, we will probably have a large number of speculators trying to pick the bottom for a quick gain, which will only create further losses. This type of kamikaze investing may work once or twice but will eventually finish you. Learn to play the trends, do your own analysis, and learn to anticipate these types of moves. Emotionally reacting to a market event is a risky strategy.

Friday, 16 January 2015

The SNB- What's going on?

The surprise decision by the SNB to remove the Franc's peg to the Euro has caused major headaches for currency institutions and Swiss stock investors.

The Swiss bank stated only last month that they would defend the 1.20 floor at all costs, implementing negative interest rates, in an attempt to deflect Russian capital flows, fleeing the turmoil in the Ruble. Since the bank's announcement however, the snap election scheduled in Greece for January 25th is sure to see anti-austerity party Syriza taking control, while the ECB edges closer to a QE program. Analysts have suggested there is only a 20% chance of a Greek exit from the Eurozone, according to Bloomberg, yet many of these so-called analysts are politically pressured to avoid rocking capital markets and the bond markets will decide the fate of Greece as they did during the last crisis.

With this in mind, we should look at current events as a prelude to another Eurozone crisis and we need to follow capital flows, in order to predict future market movements. In my post of year-end closings I concluded that the Euro would make a certain test of the 1.20 level. This has occurred and we have now crashed through it to 1.15. For those who weren't paying attention, we are now lower than the levels of the Eurozone crisis and the lowest levels in over 10 years.

The Swiss bank stated only last month that they would defend the 1.20 floor at all costs, implementing negative interest rates, in an attempt to deflect Russian capital flows, fleeing the turmoil in the Ruble. Since the bank's announcement however, the snap election scheduled in Greece for January 25th is sure to see anti-austerity party Syriza taking control, while the ECB edges closer to a QE program. Analysts have suggested there is only a 20% chance of a Greek exit from the Eurozone, according to Bloomberg, yet many of these so-called analysts are politically pressured to avoid rocking capital markets and the bond markets will decide the fate of Greece as they did during the last crisis.

With this in mind, we should look at current events as a prelude to another Eurozone crisis and we need to follow capital flows, in order to predict future market movements. In my post of year-end closings I concluded that the Euro would make a certain test of the 1.20 level. This has occurred and we have now crashed through it to 1.15. For those who weren't paying attention, we are now lower than the levels of the Eurozone crisis and the lowest levels in over 10 years.

The Euro is now on a date with parity.

Gold is now looking to test the long-term trend-line around $1300 and it's possible that some smart money has bought into gold. I would be wary of this level and would need to see more follow-through. We may see a further drop in gold - possibly on forced liquidations - before we get the final multi-year low.

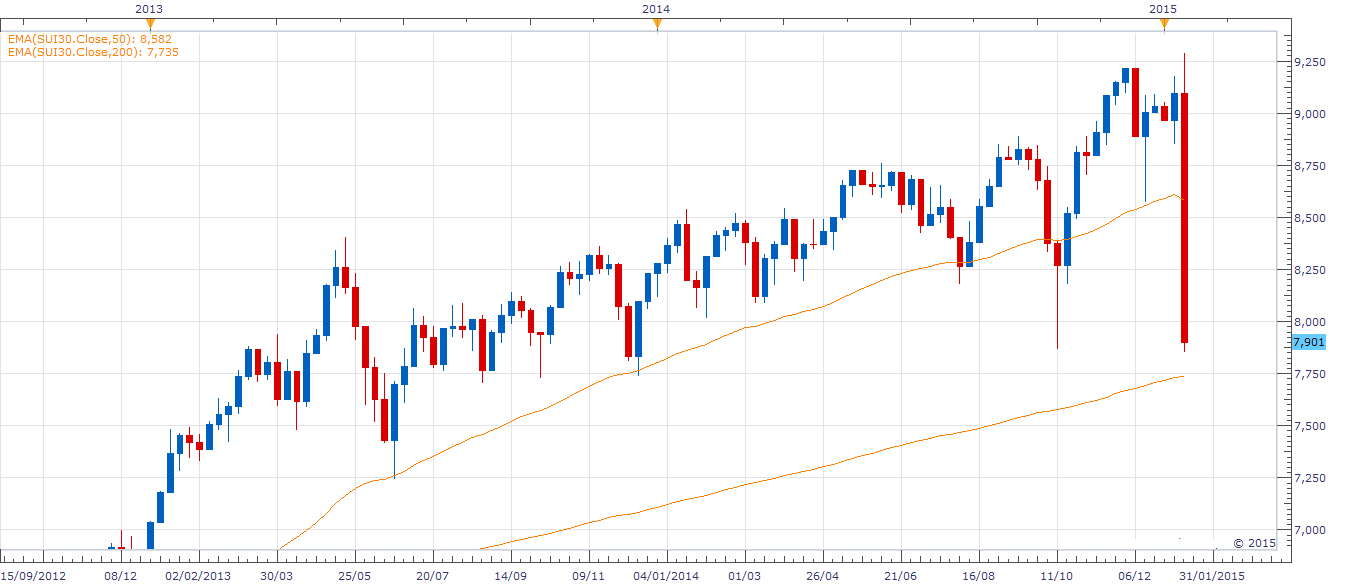

Stocks in the Swiss Market Index have been crushed since the news, with exporters being hard hit on the currency moves.

In contrast, the DAX is hitting record highs, while the Dow is falling from tough resistance.

So what's going on in the markets? Bonds in Greece and the Eurozone have fallen over the last month as the markets feared the consequences of a Syriza victory, but have bounced a little recently on hopes of a softened stance from Syriza. Following the SNB's move, the smart money has now exited the Swiss market due to currency valuations and investors are now seeking security in Swiss bonds, where the ten-year has gone negative, and in Germany, who have also seen yields falling. The advance in the Dax is showing that investors are also happy to take positions in the large-cap European stocks, rather than invest in peripheral bonds, with the safe havens now going negative. Despite comments within the EU that Greece would not create systemic problems, the markets still do not trust these views, while the SNB's U-turn only underlines the risks of trusting the power of policy-makers over markets.

These movements are important to understand if we are to see further turmoil in Europe after the Greek election. The Euro looks destined to hit parity against the dollar; gold will find a bottom soon (if it hasn't already); and bond investors will shun peripheral, risky bonds preferring to accept negative returns rather than take the risk of large bond losses or bank bail-ins like we saw in Cyprus. This is not a time to be taking positions in risky bonds, or in areas such as Greek shares. With the ECB looking to implement QE and the risk of contagion from Greece once again, this is a time to be cautious. The problems that we have seen in the currency brokers is another note of caution for investing in risky areas.

Monday, 12 January 2015

Crude speculators are still long

This is a very important, and quite stunning, chart for those looking to call the bottom in crude oil.

As I've mentioned in previous posts; alongside the extreme build in supply and declining demand, a real driver of this collapse in crude has been the rush-to-the-exit from speculators. The build in speculative positions, highlighted in black, has been huge, after a base in mid-2010 and has stretched beyond all historical averages.

Futures positioning always finds commercial positions (blue) at the right side of market turns and this time was no different. It's clear from the chart that commercial players handed their longs to speculators around the $100 level and the continued declines have led to a flood of loss-taking.

The worrying issue for anyone bullish on oil, is the realization that speculators are still long, and largely so, from a historical perspective. If we hold under $50 and continue lower in the medium-term then more of these longs will surrender. If we get a counter-trend bounce in oil and more bullish entrants, it will only increase the pain in the long run.

As I've mentioned in previous posts; alongside the extreme build in supply and declining demand, a real driver of this collapse in crude has been the rush-to-the-exit from speculators. The build in speculative positions, highlighted in black, has been huge, after a base in mid-2010 and has stretched beyond all historical averages.

Futures positioning always finds commercial positions (blue) at the right side of market turns and this time was no different. It's clear from the chart that commercial players handed their longs to speculators around the $100 level and the continued declines have led to a flood of loss-taking.

The worrying issue for anyone bullish on oil, is the realization that speculators are still long, and largely so, from a historical perspective. If we hold under $50 and continue lower in the medium-term then more of these longs will surrender. If we get a counter-trend bounce in oil and more bullish entrants, it will only increase the pain in the long run.

Sunday, 11 January 2015

Don't be the bag holder

Nice channel on CAM here:

Note the failure at the top end of the channel, followed by a collapse to the lower line. Price has fallen under this and made a retest of the support line.

CAM could flush through the low here and fall further; or it could create a double bottom and try to get back inside the channel. Either way, the use of technical analysis gives us a clear edge. If you're a serious investor, don't be left holding the bag at the failure of the $75 level.

Making calls

I wanted to highlight a call I made on Stocktwits previously:

http://stocktwits.com/message/29693332

At the time, price was labouring around $100.30 and I stated that failure to hold would likely see a test of $85.

A few weeks later and price had indeed crashed to that level, after a failed attempt to push higher.

This is why you need to use a mix of fundamental - and technical - analysis. If you liked Gilead at $100; you'll like it even better at $85.

http://stocktwits.com/message/29693332

At the time, price was labouring around $100.30 and I stated that failure to hold would likely see a test of $85.

A few weeks later and price had indeed crashed to that level, after a failed attempt to push higher.

This is why you need to use a mix of fundamental - and technical - analysis. If you liked Gilead at $100; you'll like it even better at $85.

Subscribe to:

Posts (Atom)

%2B%2BWeek%2B17_2010%2B-%2BWeek%2B2_2015.jpg)

%2B%2BWeek%2B9_2012%2B-%2BWeek%2B2_2015.jpg)